Table of Contents

- New Roth 401(k) Rule Changes: What You Should Know for 2025 | Kiplinger

- How Much Contribute … - Adelle Crystal

- The Champions of the 401(k) Lament the Revolution They Started - WSJ

- Max 401k Employer Contribution 2025 - Lillian Wallace

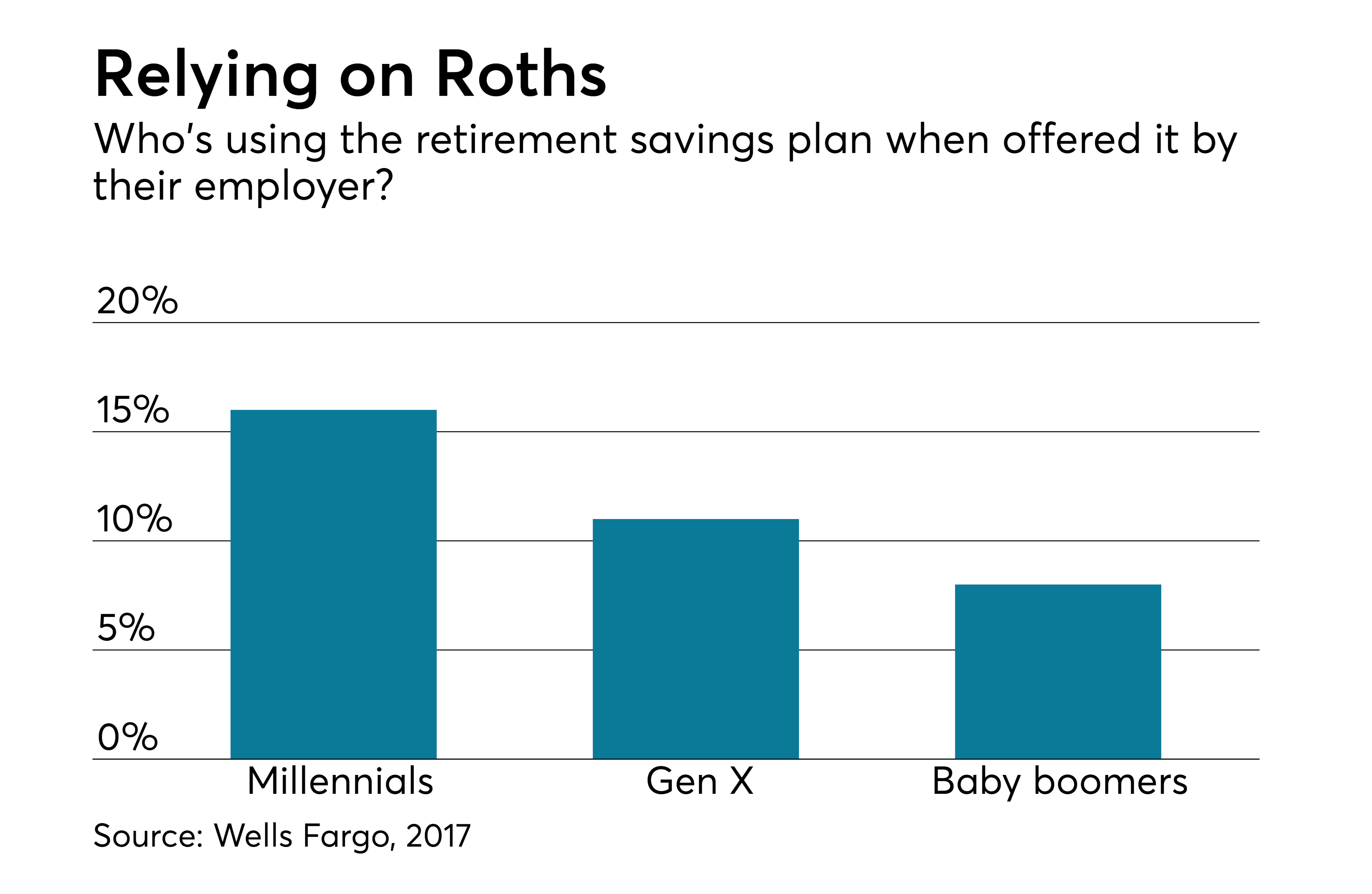

- Roth 401 K

- 2025 401(k) and IRA contribution limits: What you need…

- IRS Delays Secure 2.0 Mandatory 401k Catch-up Contributions until 2026 ...

- Roth 401 K Income Limits 2024 Employer Match - Tomi Agnesse

- How Much Should I Contribute to My 401(k)?

- The Champions of the 401(k) Lament the Revolution They Started - WSJ

What are 401(k) Catch-Up Contributions?

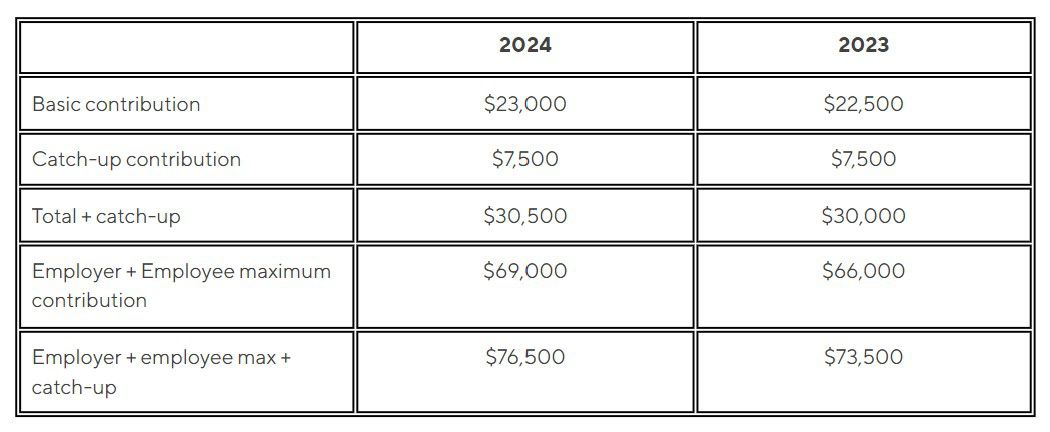

2025 Updates

2026 Updates

Looking ahead to 2026, the IRS has announced the following updates: The standard annual contribution limit for 401(k) plans will increase to $23,000. The catch-up contribution limit for individuals 50 and older will increase to $8,000. The overall limit for defined contribution plans will increase to $67,500. These updates will provide even more opportunities for older workers to boost their retirement savings. With the increased catch-up contribution limit, you can contribute an additional $8,000 to your 401(k) plan, bringing your total annual contribution to $31,000.