Table of Contents

- Microsoft Stock (MSFT) Near Major Trading Price Objective - See It Market

- Is Microsoft Stock a Buy, a Sell, or Fairly Valued After Earnings ...

- Buy or Sell Microsoft as It Eyes Stake in ChatGPT Owner OpenAI? - TheStreet

- Microsoft Stock at All-Time High After Strong Quarter

- Microsoft (MSFT) Stock Will Become Attractive Following a Pullback ...

- How To Trade Microsoft Corporation Stock Ahead of Earnings and Earn a ...

- Trade Microsoft: Your guide to trade Microsoft | Capital.com | Trade now

- Microsoft's big earnings beat is because of one business that is ...

- How to Trade Microsoft After It Reports Earnings - TheStreet

- Microsoft Stock Forecast 2022, 2023, 2025, 2030

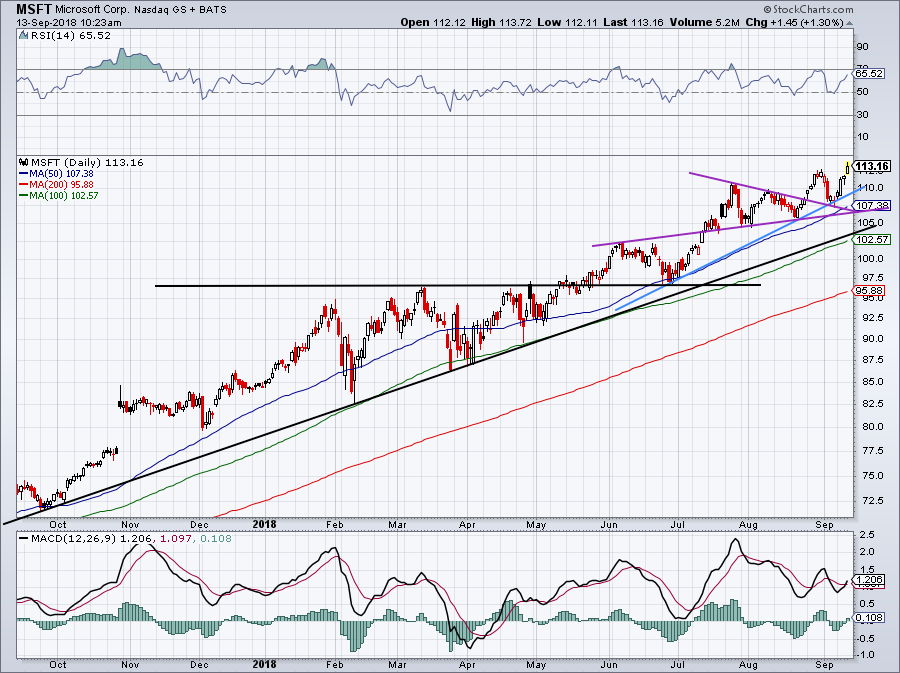

Current Stock Price and Performance

Historical Performance

Products and Services

Microsoft's success can be attributed to its diverse range of products and services. The company's flagship product, the Windows operating system, remains one of the most widely used operating systems in the world. In addition to Windows, Microsoft offers a suite of productivity software, including Office 365, which has become an essential tool for businesses and individuals alike. The company has also made significant strides in the cloud computing space, with its Azure platform competing with Amazon Web Services (AWS) and Google Cloud Platform (GCP).:max_bytes(150000):strip_icc()/msft1-51ff9ae22f094031bd5081b4a0734afa.jpg)

Future Prospects

Microsoft's future prospects look promising, with the company investing heavily in emerging technologies such as artificial intelligence (AI), machine learning (ML), and the Internet of Things (IoT). The company's acquisition of LinkedIn in 2016 has also expanded its presence in the professional networking space. With a strong financial foundation and a talented workforce, Microsoft is well-positioned to continue innovating and growing in the years to come.

Investment Opportunities

For investors looking to add Microsoft (MSFT) stock to their portfolio, there are several options available. The stock can be purchased through a brokerage firm or online trading platform. Investors can also consider investing in exchange-traded funds (ETFs) or mutual funds that track the technology sector or the S&P 500 index. With its stable financials and growth prospects, Microsoft stock is an attractive option for both short-term and long-term investors. In conclusion, Microsoft (MSFT) stock is a solid investment opportunity for those looking to tap into the technology sector. With its rich history, diverse range of products and services, and promising future prospects, Microsoft is a company that is poised for continued success. Whether you're a seasoned investor or just starting out, Microsoft stock is definitely worth considering.Disclaimer: This article is for informational purposes only and should not be considered as investment advice. Investors should conduct their own research and consult with a financial advisor before making any investment decisions.