Table of Contents

- Summary of current CYP PPI data collection | Download Table

- PPI network analysis. (a) PPI network of targets constructed using ...

- 1 Historical Trend of PPI Projects by Region (over the period ...

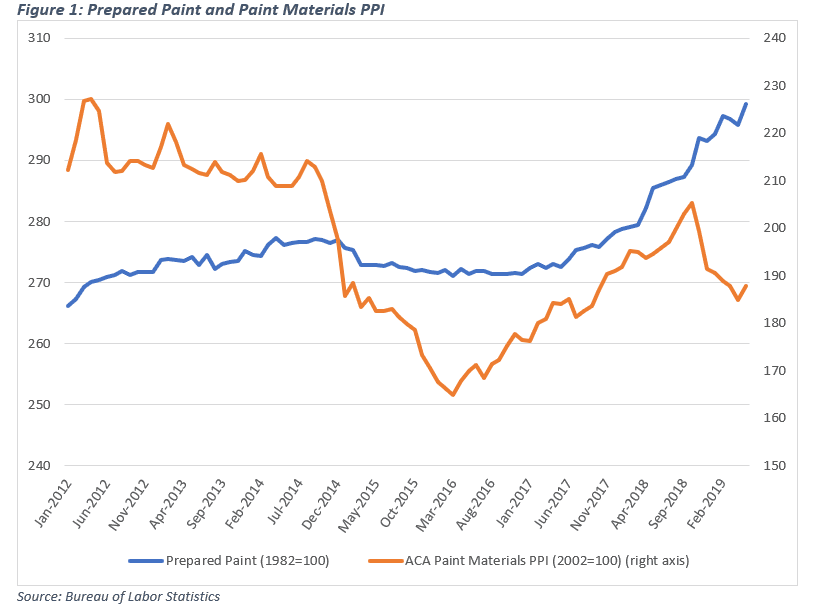

- PPI Data Provide Insight into Industry Pricing Trends — American ...

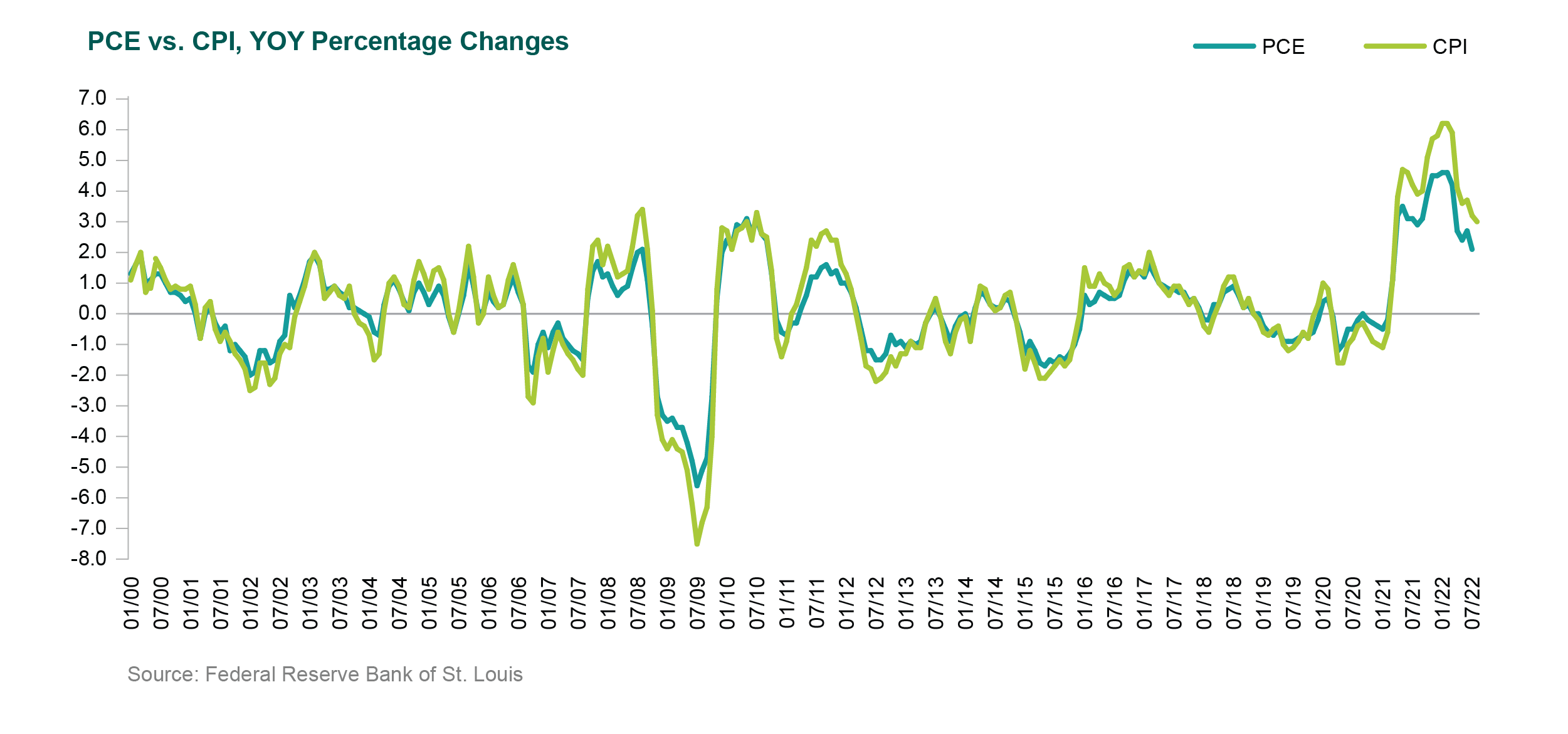

- Charts of the Day: PPI Doesn’t Lead CPI | Insights | Fisher Investments

- Ppi Vs Cpi 2024 - Anica Shannen

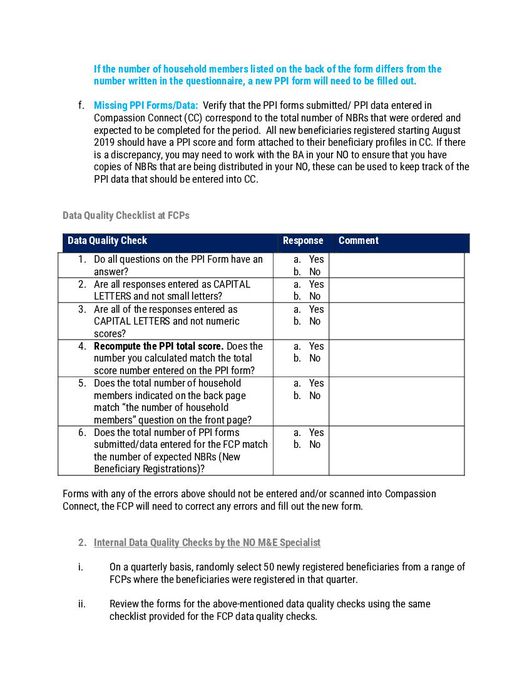

- PPI Data Quality and Validation Instructions | ForChildren

- Premium Photo | Text PPI (Producer Price Index)business concept finger ...

- What is PPI (Producer Price Index) - Why is it important for Traders?

- Futures Trading: PPI data

What is the Producer Price Index (PPI)?

Why is PPI Important?